Your EMI Health Medical Plan

Discover what's included, how coverage works in your state, and how to make the most of your benefits.

Your EMI Health Medical Plan

Discover what's included, how coverage works in your state, and how to make the most of your benefits.

Your built-in support system for feeling better and staying healthy, with free resources and tools from WebMD to help you build healthier habits that last.

Don’t leave money on the table—use your preventive care benefits.

Annual checkups, screenings, and vaccines are covered at no cost when you stay in-network. Schedule yours early and stay ahead of potential health issues.

Copay Plans

![]()

These plans offer predictable costs for common healthcare services. You’ll typically pay:

-

A set copay for things like office visits and prescriptions

-

A separate deductible and coinsurance for larger expenses like hospital care or imaging

Traditional plans are a good fit if you prefer knowing your costs up front when you go to the doctor or pick up a prescription.

-

Monthly Premiums: Higher

-

Upfront Costs: Copays for doctor visits and prescriptions

-

Budget Predictability: More predictable

-

Healthcare Usage: Frequent doctor visits, chronic conditions

-

HSA Eligibility: Not eligible

High Deductible Health Plans (HDHPs)

![]()

HDHPs have a higher deductible that you pay before the plan starts covering services. However, they usually come with:

-

Lower monthly premiums

-

The option to pair with a Health Savings Account (HSA) if the plan is HSA-qualified

HDHPs can be a great option if you want to lower your monthly costs, are generally healthy, or want to save for future medical expenses.

HSA-qualified HDHPs are marked with a “Q” in front of the plan name. These allow you to save pre-tax dollars in an HSA to pay for eligible healthcare expenses.

-

Monthly Premiums: Lower

-

Upfront Costs: You pay full cost until deductible is met

-

Budget Predictability: Less predictible but potential for long-term savings

-

Healthcare Usage: Infrequent visits, low ongoing care

-

HSA Eligibility: Only HSA-qualified plans (QHDHP) qualify

Check Your Plan Summary

Every employer group may offer different plans or coverage levels.

To find out which plan(s) are available to you—and how each one works—refer to your plan summary in the back of your enrollment booklet, or log in to the EMI Health member portal after enrolling.

Preventive care is always covered at 100% when you use in-network providers, even before you meet your deductible.

- You Pay 100% Until Your Deductible Is Met

At the start of the year, you pay the full cost of most services until you reach your deductible. This includes things like doctor visits, lab work, or outpatient care. - After That, You Share Costs with EMI Health

Once you meet your deductible, coinsurance kicks in. That means you pay a portion of the costs (like 20% or 30%), and EMI Health pays the rest. This continues until you hit your out-of-pocket maximum. - We Cover 100% After You Hit the Max

When you reach your annual out-of-pocket maximum, EMI Health pays for 100% of eligible in-network expenses for the rest of the year.

-

Utah

-

Arizona

-

Texas

-

Georgia

Utah: Care Plus Network

In Utah, EMI Health's Care Plus Network offers comprehensive coverage through:

-

Intermountain Healthcare (IHC): A trusted, nonprofit health system with a significant presence in Utah, including 33 hospitals and over 385 clinics and outpatient centers.

-

Expanded Provider Access: EMI Health contracts with additional hospitals, specialty clinics, and provider groups, bringing the total number of in-state providers to over 30,000.

-

Out-of-State Coverage: For services outside Utah, your plan may utilize either the Aetna National PPO or the Cigna PPO network, providing nationwide access to quality care

Need to find a provider near you?

Use the tools below to see who’s in-network and where to go for care across the state:

Arizona: How Your Network Works In and Out of State

If you're enrolled in an EMI Health medical plan in Arizona, your network gives you access to care both locally and across the country. While each network functions a little differently, all are designed to connect you with high-quality providers whether you’re at home, traveling, or living part-time in another state.

Utah is the only exception, where EMI Health uses its own Care Plus Network to ensure members receive the same level of access and cost control.

Your plan materials will tell you which network you're on—read on to learn more about each option and search for providers in your network.

Cigna PPO

Offers a vast network of over 1.5 million healthcare professionals, ensuring broad access to care.

Aetna PPO

Known for its extensive provider network and high customer satisfaction ratings.

Blue Cross Blue Shield of Arizona™ + First Health

When you're in Arizona, your EMI Health plan connects you to the Blue Cross Blue Shield of Arizona™ network—one of the most trusted, high-quality networks in the state. When you travel or live part-time outside Arizona (except in Utah), you’re covered by the First Health nationwide network.

In Arizona: Blue Cross Blue Shield of Arizona™

You have access to a powerful network built for Arizonans.

- Includes top-rated hospitals and specialists across the state

- Features major health systems like Mayo Clinic, HonorHealth, and Dignity Health

- Designed for seamless access to routine, specialty, and urgent care near home

Whether you need a primary care doctor in Phoenix or a specialist in Flagstaff, you’re backed by a deep network of over 20,000 providers statewide focused on quality and service.

Search for Blue Cross Blue Shield of Arizona Providers: Click Here

Outside Arizona: First Health Network

Traveling for work, school, or vacation? You're still covered.

- Access to 1 million+ providers and 5,000+ hospitals across all 50 states

- In-network options for urgent care, specialists, mental health, and more

- Contracted rates help you avoid surprise bills and reduce out-of-pocket costs

Search for First Health Network Providers (Choose State to search): Click Here

Integrated Medical Services (IMS)

Arizona’s largest independent multi-specialty provider group, offering comprehensive, coordinated care across various specialties.

Texas: Aetna or Cigna PPO

In Texas, EMI Health partners with two well-established national networks—Aetna and Cigna—to ensure broad, dependable access to care across the state.

-

Aetna PPO: Recognized for its large, well-coordinated provider network, Aetna offers strong access to primary care, specialists, and hospitals, with a reputation for responsive customer support and a seamless member experience.

-

Cigna PPO: Cigna brings a robust network of healthcare professionals and facilities, with a strong focus on preventive care, care coordination, and tools that help members stay healthy and informed.

No matter which network your plan uses, you can count on access to high-quality care throughout Texas and beyond.

Georgia: Trusted Coverage Through Aetna or Cigna PPO

EMI Health members in Georgia are covered through either the Aetna PPO or Cigna PPO network—two nationally recognized carriers known for quality care and broad access.

-

Aetna PPO: Aetna is known for its reliable network of doctors, hospitals, and specialists throughout Georgia. Members benefit from a strong emphasis on preventive care and tools to manage their health with confidence.

Search for Georgia Aetna PPO Providers -

Cigna PPO: With a wide-reaching network and a strong presence in both urban and rural parts of Georgia, Cigna focuses on whole-person care, making it easier to stay on top of both routine and specialized health needs.

Whether you're in Atlanta or a smaller community, these networks ensure access to high-quality providers across the state—and throughout the U.S.

Prescription Drug Coverage

EMI Health partners with Express Scripts to bring you flexible, cost-conscious prescription drug coverage. With access to over 68,000 retail pharmacies, a convenient home delivery service, and specialized support for complex conditions, managing your medications is easier than ever.

Medication Tiers & Common Cost Patterns

| Tier | Retail (30-day supply) | Home Delivery (90-day supply) |

| Generic Drugs | Lowest Cost | Usually 2x Retail |

| Preferred Brands | Mid-range Cost | Savings with 90-day fill |

| Non-Preferred | Highest Cost | Better Value by mail order |

Traditional Copay Plan Members

- You may have a separate prescription deductible, or you may pay copays by drug tier from day one.

(Q)HDHP Plan Members

- You’ll pay the full cost of prescriptions until your combined medical and pharmacy deductible is met. After that, your plan starts sharing the cost.

For your exact pricing and benefit details, check your plan summary (found in your enrollment booklet or online member portal).

Pharmacy look-up tool.

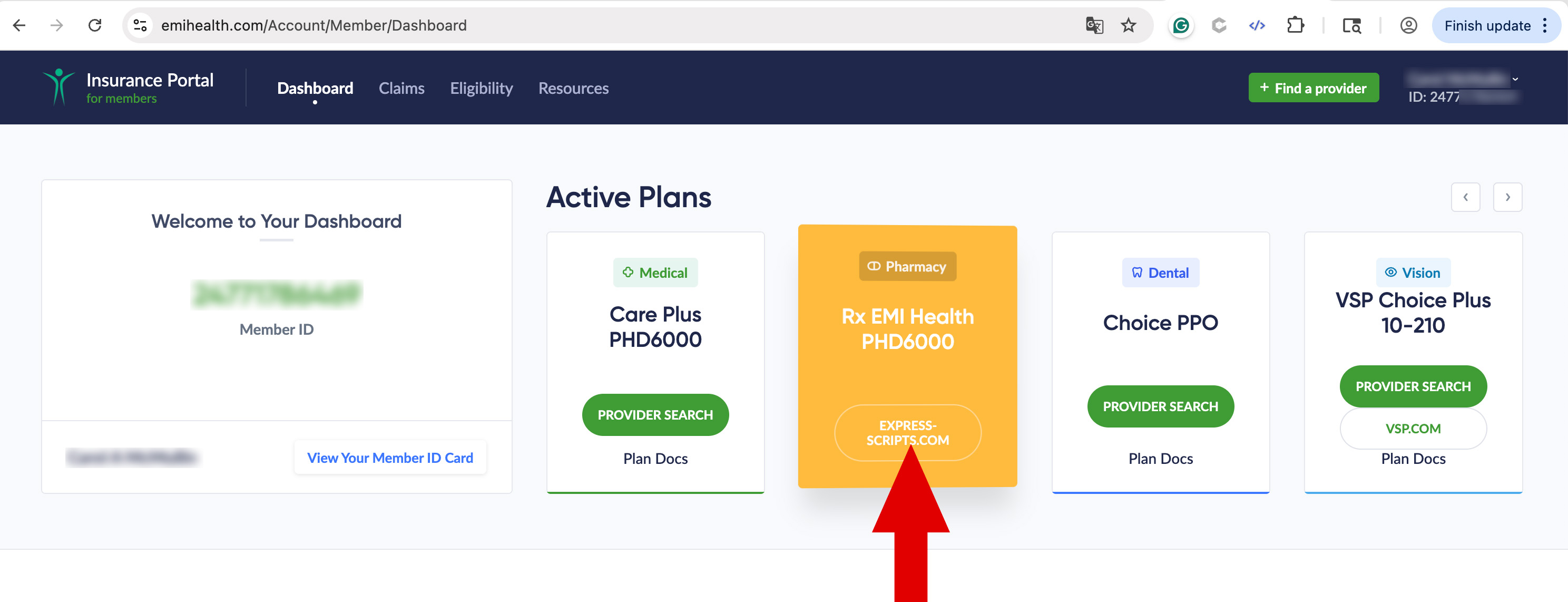

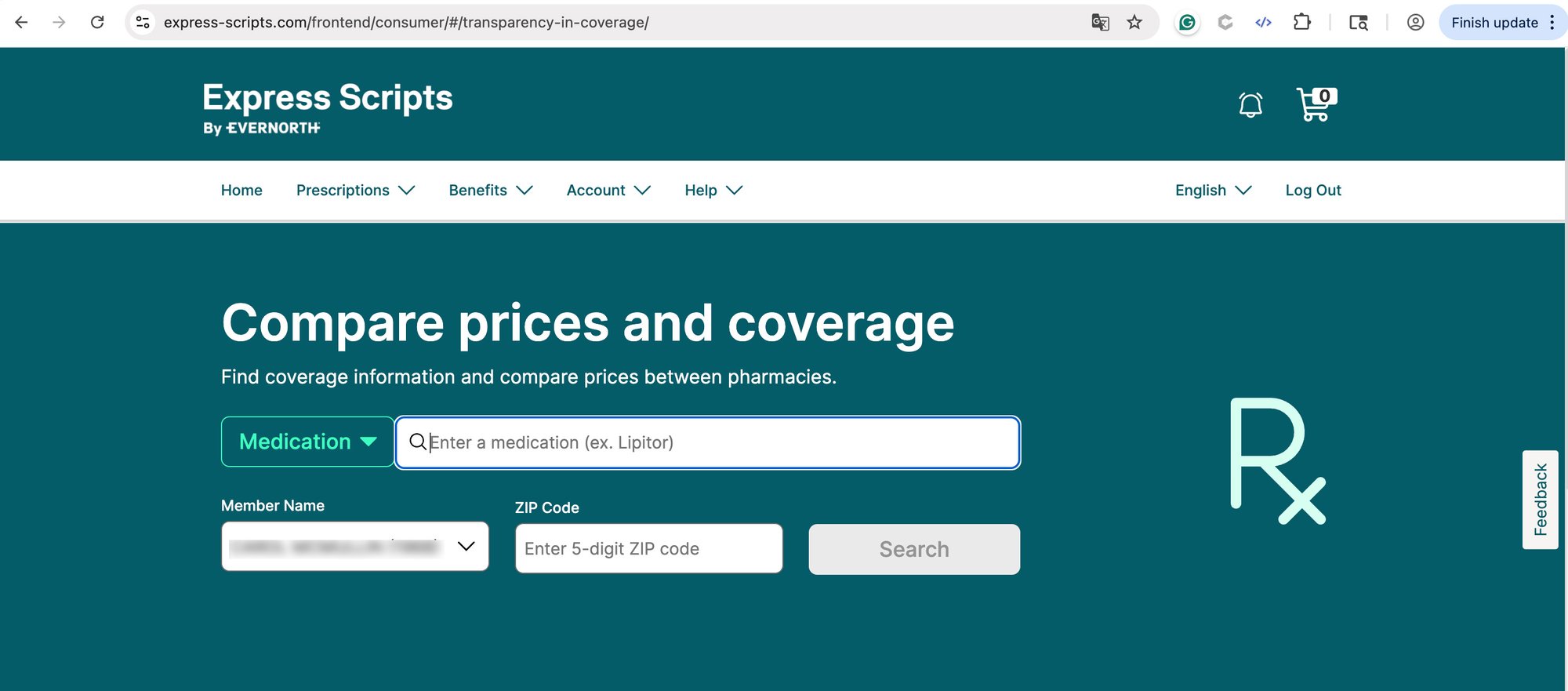

If you are currently enrolled in an EMI Health plan, you will get the most accurate pricing to your benefit, including current out-of-pocket calculations, by logging in and using the pharmacy tool within your personalized My EMI Health account.

- Log in to your My EMI Health account..

- From your dashboard locate your pharmacy.

3. You will be redirected to Express Scripts.

4. Sign in using your EMI Health credentials.

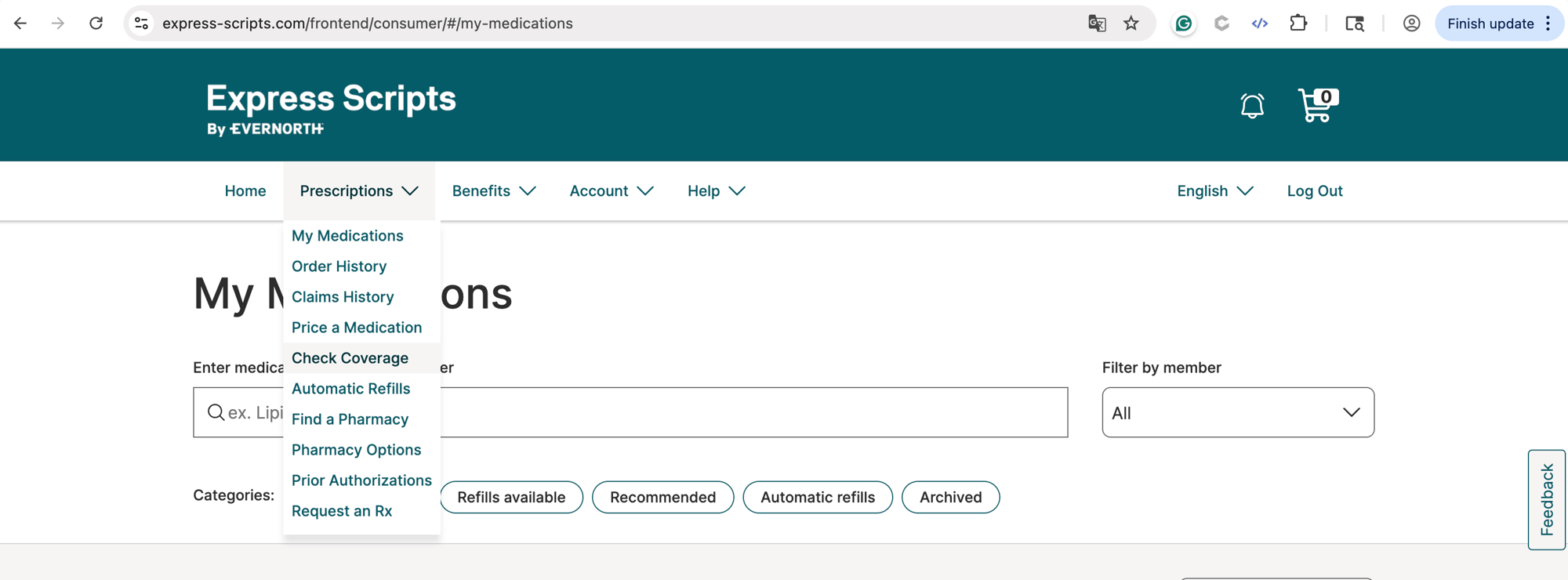

5. Check Coverage under the Prescriptions menu.

Ways to Fill Prescriptions

Retail Pharmacies

Over 68,000 in-network locations for short-term needs

Including:

![]()

![]()

![]()

.svg.png?width=100&height=83&name=Kroger_logo_(1961-2019).svg.png)

Home Delivery

Great for ongoing medications; usually saves time and money

Use generics or preferred brands when available and refill maintenance medications through home delivery.

Reach out to Express Scripts Member Services at 866-815-0003 for support anytimeExpress Scripts SaveOnSp Program

With Accredo, any speciality medications your doctor has prescribed you'll get:

- Personalized care from pharmacists who specialize in your condition

- 24/7 support and medication counseling

- Home delivery with refill reminders

Through the SaveOnSP program, some eligible specialty medications may cost $0 per month.

$25 Insulin & Diabetes Medications

The Patient Assurance Program (PAP) helps manage out-of-pocket costs for certain insulin and Type 2 diabetes medications. If you're eligible:

- Your copay is capped at $25 per 30-day supply

- This applies regardless of deductible status or plan type (HDHP or copay)

- Automatically applied at participating pharmacies

Covered medications include (subject to change):

- Insulin: Humalog®, Semglee® (yf)

- Type 2 Diabetes Medications: Mounjaro®, Rybelsus®, Trulicity®, Jardiance®

TELEHEALTH

$0 Copay

TeleMed is perfect for minor aches and ailments.

-

allergies

allergies

-

asthma

asthma

-

cold or flu

cold or flu

-

Ear Ache

Ear Ache

-

Rash

Rash

-

Sore Throat

Sore Throat

OFFICE VISIT

$$

Visit your in-network provider for non-life-threatening conditions.

-

preventive care

preventive care

-

routine care

routine care

-

sprains

sprains

-

minor cuts or burns

minor cuts or burns

-

back pain

back pain

URGENT CARE*

$$$

Urgent Care facilities offer the convenience of extended hours and lower costs for many non-life-threatening emergencies.

-

stitches

stitches

-

x-rays

x-rays

-

broken bones

broken bones

-

labs

labs

EMERGENCY ROOM**

$$$

Visit the Emergency Room for serious and/or life-threatening conditions.

-

trouble breathing

trouble breathing

-

signs of stroke

signs of stroke

-

severe chest pain

severe chest pain

-

deep wound

deep wound

-

head or spine injury

head or spine injury

*During business hours, check with your network provider to see if they can handle your condition before going to urgent care.

**If you are experiencing a medical emergency, call 911 or go to the nearest emergency room immediately. This information is not a substitute for emergency care. EMI Health is not liable for decisions made in urgent or life-threatening situations.

What is an HSA?

What is an HSA?

A health savings account, often abbreviated to HSA, is a benefit that is offered in conjunction with a high-deductible health insurance plan. Your employer may offer an HSA, or if you’re self-employed, you may qualify for an HSA if you have a qualified high-deductible health plan.

This type of savings account is designed for use on covered healthcare expenses. You can contribute untaxed dollars to the account from your gross income.

The funds in an HSA can be used for a number of approved expenses, including:

• Medical care (e.g., doctor visits, hospital stays)

• Eyeglasses

• Contact lenses

• Chiropractic care

• Prescription drugs

• Certain over-the-counter drugs

• Physical therapy

• Speech therapy

When used for qualified medical and health expenses, withdrawals from an HSA are tax-exempt.

There are contribution limits to how much you can put into an HSA each year. For 2025, the current limit is $3,600 per individual and $7,200 per family. If you are 55 or older, you can put an additional $1,000 in the account per year.

What is an FSA?

A flexible spending account, or FSA, is another benefit that stores pre-tax money to spend on qualified healthcare expenses. Some employers also offer a dependent care FSA benefit, which allows parents or guardians to set aside pre-tax funds to spend on qualified dependent care expenses.

Funds in an HSA roll over from year to year, but the funds in your FSA must be spent within the plan year or the money is forfeited. Some plans offer a grace period to use the funds in an FSA. The current annual contribution limit for an FSA is $2,750.

An FSA is available through a group plan, such as a health plan offered by an employer, but is not available to self-employed individuals. The annual amount you allocate to your FSA will be available at the start of the plan year, and regular payroll deductions will cover the sum.

The employer providing the FSA technically owns the account, so if you leave your job before using all of the funds, you would not be able to take the money with you or move it to another account.

Main Difference

A key difference between an HSA and an FSA is the ability to roll over the funds in an HSA. HSA funds do not expire at the end of the plan year but can be maintained in the account indefinitely. If your HSA is offered through your employer, you get to keep the money because it’s your money that you have set aside from your payroll.

Which to choose?

The first consideration when deciding between an FSA and HSA is whether you qualify for both. To have an HSA, you must be enrolled on a high-deductible health plan. If you aren’t on a qualifying plan, you wouldn’t be eligible for an HSA. Similarly, if you are self-employed, you wouldn’t qualify for an FSA.

If you do qualify for both, it helps to consider your typical healthcare expenses. If you require substantial medical care or are prescribed expensive drugs, it may make sense to choose an FSA as you’re likely to use all of the funds.

If you tend to be on the lower end of healthcare utilization, you might choose a high-deductible plan with an HSA. If you don’t use all the money in the account during the plan year, it rolls over to the next (and every year thereafter).

If you have questions about your health plan coverage options, talk to your health plan to get more information. Making an informed decision during open enrollment can help ensure that you have the coverage you need for the upcoming year.

Access Top-Tier Care with EMI Health's Elite Provider Tier

At EMI Health, we believe you deserve the best care possible. That's why select copay plans include access to our Elite Provider Tier—a curated group of high-performing doctors and facilities within the Care Plus, Aetna, and Blue Cross Blue Shield networks.

What does this mean for you?

-

Enhanced Quality: Elite providers are recognized for delivering exceptional care and service.

-

Lower Out-of-Pocket Costs: Enjoy reduced copays when you choose Elite providers.

-

Streamlined Access: Easily identify Elite providers through our Provider Search Tool.

How to Search for a Tier 1 Elite Provider

Watch this quick video to learn how to search for Elite providers directly from your EMI Health member dashboard—it’s simple, fast, and helps you make the most of your benefits.

Tier 1 Elite Booklet

.jpg?width=400&height=459&name=customer_service_AdobeStock_219286958%20(1).jpg)

Customer Service

Whether you’re looking for help with benefits, claims, ID cards, or something else—we’ve got a knowledgeable, friendly team ready to assist.

We’re committed to making your experience as smooth as possible. If something doesn’t make sense, just ask—we’ll walk you through it.

_Page_1.jpg?width=150&height=194&name=Elite%20Network%20Guide%20(1)_Page_1.jpg)