Better Care. Real Rewards.

Garner is a benefit that works alongside your EMI Health plan to help you find top-performing doctors—and get reimbursed for eligible medical costs. It’s a smarter, simpler way to save on care.

EMI Health and Garner

A fully-integrated experience guaranteed to improve health outcomes and save money.

Watch how it works with your EMI Health Plan

↓

Set Up Your Garner Account

As soon as you’re enrolled in your EMI Health medical plan and have your Member ID number, download the Garner app and create your account.

Setting up your account early means you can start using Garner right away—to find top doctors and get money back on your medical costs.

SCAN TO DOWNLOAD OR VISIT

SCAN TO DOWNLOAD OR VISIT

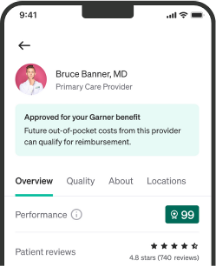

Select Your Provider in the Garner App BEFORE Your Appointment!

Selecting your provider in the Garner app before your appointment is one of the most important steps to ensure a smooth experience and qualify for reimbursement.

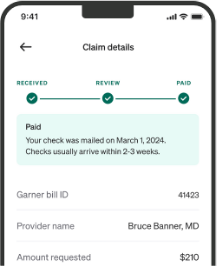

Setting Up Direct Deposit

When you receive care from a Top Provider who was added to your Care Team before your appointment, pay your upfront costs as usual. Garner has access to your insurance plan’s claims. After EMI Health processes the claim, Garner will reimburse your qualifying out-of-pocket medical costs.

You have two options for receiving reimbursement:

-

Recommended - direct deposit: If you are the primary member you can set up direct deposit for faster and more secure reimbursement. Because the speed that billing departments submit claims to your health insurance company can vary, it typically takes 5-6 weeks to receive reimbursement after the service takes place.

-

If you do not set up direct deposit, a reimbursement check in a white envelope will be sent to the mailing address the primary member has on file with their employer, arriving in about 6-8 weeks.

Garner FAQs

Does my Garner account serve my entire family?

Your family only needs one account. However, any dependent over the age of 18 who is on your health insurance plan is welcome to create their own account.

How do I choose a provider?

Here's how:

-

Open the Garner Health app and find your doctor’s profile page.

-

Click “Request approval.”

-

Follow the on-screen workflow to complete the request.

-

Once your doctor is approved, go to “Settings” on the home screen.

-

Click “Approved providers” to view your list.

-

Your approved doctors will appear with an “Added on” date.

-

Out-of-pocket costs for services from that doctor are eligible for reimbursement starting from that date.

Please Note: To be eligible for reimbursement, your providers MUST be selected and added to your Garner App BEFORE your appointment.

For issues or questions, please use Garner's Concierge service within the app.

What if my approved provider recommends I see a specialist?

All new providers, including specialists, MUST be Top Providers in order to qualify for the Garner benefit.

If you need to find a new provider, use the Garner Health app to find a Top Provider or contact the Concierge for assistance.

Specialists must be added to your list of approved providers prior to the date of service in order for out-of-pocket medical costs to qualify for reimbursement.

For example, if your PCP recommends that you see a GI specialist for stomach pain, you must check with Garner to ensure the specialist is a Top Provider, and then add them to your list of approved providers before your date of service.

What out-of-pocket medical costs will be reimbursed?

Your out-of-pocket medical costs will qualify for reimbursement if:

- You have created a Garner account and added the provider to your list of approved providers prior to the date of service. (Learn how to add providers to your list.)

- Your provider is in-network and the cost was covered by your health insurance plan. (Check your health insurance plan.)

- The type of cost qualifies for reimbursement under your Garner plan. Depending on your Garner plan, costs for things like prescription drugs or emergency services may or may not qualify for reimbursement. (Check the Your benefit page in the Garner Health app to learn more.)

- If your health insurance plan is paired with an HSA, you will need to incur costs greater than the minimum deductible. (Check the Your benefit page in the Garner Health app to see if this requirement applies.)

How does Garner choose top providers?

Top Providers are the best-performing medical professionals that Garner has identified through an analysis of over 60 billion medical records representing more than 310 million unique patients.

Top Providers are the top 20% of all providers in the industry. They are highlighted in the Garner Health app with a green Top Provider badge and represent the best available doctors near you who are in your network and have appointment availability.

Their analysis determined that patients who see their top providers:

- Diagnose health problems more accurately.

- Prescribe the right treatments based on the latest research

- Have the lowest cases of hospital readmissions

What is the Garner Concierge?

The Garner Concierge is a group of professionals dedicated to answering your questions and helping you find the best care for you and your family.

You can message the Concierge through the Garner Health mobile app, at getgarner.com or by emailing concierge@getgarner.com.

The Concierge team is available Monday through Friday from 8:00 a.m. to 8:00 p.m. ET.. Se habla español.

What if I have an HSA?

An HSA is a Health Savings Account. You and your employer are able to contribute pre-tax dollars to this account. Because of IRS requirements, two main rules apply.

First, if you have a high-deductible health insurance plan (HDHP) that is paired with an HSA, you are required to spend a minimum amount toward your health insurance deductible before you can utilize your Garner HRA.

This amount changes annually and depends on whether you have a family or individual plan. Check the “Your benefit” page in the Garner Health app for more detailed information about this amount. Note that this rule applies even if you are not actively contributing to your HSA this year.

Second, you may not request reimbursement from your Garner HRA for any out-of-pocket cost you have already paid for using funds from your HSA. This is often referred to as double dipping and is prohibited by the IRS.

Does Garner work with FSA's?

If you have a health Flexible Spending Account (FSA), special rules apply to your Garner benefit.

You may not be reimbursed by the Garner HRA for an out-of-pocket medical cost that will also be paid using your FSA. This is often referred to as double-dipping and is prohibited by the IRS.

If your Garner HRA and your FSA cover the same medical cost, we recommend you use and exhaust your Garner funds before using your FSA. You can save your FSA for when your Garner benefit has reached its limit or for out-of-pocket medical costs that do not qualify for reimbursement by Garner.

Garner’s Concierge Team Is Here for You

If you ever need help finding a doctor, understanding your benefits, or using the Garner app, the Concierge team is ready to assist.

You can reach out through the app’s chat feature or by phone to get:

Personalized help finding top-rated, in-network doctors near you

Answers to questions about your plan, coverage, or reimbursements

Support with any part of the Garner experience

Members often say the Concierge team is fast, friendly, and makes healthcare feel easier.

To get started, open the Garner app and tap the chat icon, or visit getgarner.com/contact.

How Garner Works

Watch this quick video to see how simple it is to use Garner—find top doctors, make smart choices, and get reimbursed when you do.

What our members are telling us

“Received a super fast response to my question! Concierge agent was awesome!”

"Very thorough responses and provided multiple option of doctors to suit both myself and my spouses preferences."

“I was able to find a specialist quickly—and ended up with a doctor I truly love. It felt so good to go into my appointment with confidence.”