Dental Coverage with EMI Health

EMI Health dental plans help make dental care more affordable and easier to use—whether you purchased your plan directly or receive coverage through your employer.

From routine cleanings to more complex procedures, your plan is designed to support your oral health while keeping costs predictable.

Understanding Dental Plans

EMI Health offers several types of dental plans to fit different needs and budgets.

Your available plan options depend on the coverage you selected. You can review your specific dental plan details in your plan summary or enrollment materials.

No matter which plan type you have, EMI Health gives you access to a nationwide network of trusted dentists—so it’s easier to get care wherever you are.

PPO Plans

More flexibility, broader access

With a PPO plan, you can usually visit any licensed dentist. You’ll save the most when you choose a dentist in your plan’s network.

PPO plans cover preventive care, like exams and cleanings, at 100% and provide partial coverage for basic and major services.

Best for: Members who want flexibility and the option to see specialists without referrals.

-

Freedom to see out-of-network providers

Freedom to see out-of-network providers

-

No referrals needed for specialists

No referrals needed for specialists

-

Often includes a deductible and coinsurance

Often includes a deductible and coinsurance

Copay Plans

Predictable costs, simpler pricing

Copay plans use set dollar amounts for many dental services (called fee schedules), so you know your cost upfront.

Instead of paying a percentage of the bill, you pay a fixed copay for covered services, making it easier to budget for care.

Best for: Members who want budget certainty.

-

Fixed fees for each procedure

Fixed fees for each procedure

-

Often no deductible or coinsurance

Often no deductible or coinsurance

DHMO Plans

Utah & Arizona Only

Lowest cost, more structure

DHMO plans require you to choose a primary dentist from the network. That dentist coordinates your care and provides referrals when needed.

Services are typically free or have low copays when received through your assigned dentist.

Best for: Members looking for the most affordable option and who are comfortable staying within a defined network.

-

No deductible or annual maximum

No deductible or annual maximum

-

Must see your assigned dentist

Must see your assigned dentist

-

No coverage for out-of-network care

No coverage for out-of-network care

Please note: Plan features and coverage levels may vary based on your employer’s specific dental plan. Be sure to review your official plan summary for the exact benefits, costs, and provider details that apply to you.

-

Preventive Care

-

Basic Services

-

Major Services

-

Orthodontics

Includes cleanings, exams, and routine X-rays.

Preventive services are usually covered at the highest level when you visit an in-network dentist. Many plans cover these services at little or no cost to you, helping you stay on top of your oral health.

![]()

Includes services that treat common dental issues.

This category often includes:

- Fillings

- Simple extractions

- Gum (periodontal) treatment

Basic services are typically covered after preventive care, with a copay or coinsurance depending on your plan.

Includes more complex dental procedures.

This category may include:

- Crowns

- Bridges

- Dentures

- Oral surgery

Major services are usually covered at a lower percentage and may require a waiting period, depending on your plan.

Includes braces and other orthodontic treatment.

Orthodontic coverage varies by plan. Some plans include orthodontic benefits for children, adults, or both, while others do not include orthodontic coverage.

To help keep monthly premiums more affordable, many plans—especially Individual & Family dental plans—do not include orthodontic benefits.

Check your plan details to see whether orthodontic coverage is included and what limits apply.

Where to Find Your Coverage Details

Every dental plan is a little different. To see exactly what your plan covers for each type of care—check the plan benefits summary in your enrollment booklet OR your plan documents in your My EMI Health account online dashboard.

Dental Terms Made Simple.

Dental plans include a few key terms that explain how your coverage works and what you may pay out of pocket. Regardless of the type of plan you have—whether it’s individual or offered through an employer—these are common terms you’ll see across all dental insurance. Getting familiar with them can help you plan your care and avoid unexpected costs.

Deductible

Your deductible is the amount you pay out of pocket before your plan starts covering certain services.

-

Per Person: The deductible each covered member pays ($25 in this example).

-

Family Max: The total deductible limit for your whole family ($75 in this example). Once your family reaches this amount together, no additional deductible is required for the year.

-

Applies To: The plan summary shows which service types the deductible applies to (Types 1, 2, and 3 in this example).

Disclaimer: Deductibles vary by plan. Some services may not require a deductible. Always check your plan summary for your specific coverage details.

Annual Maximum

This is the most your plan will pay for covered dental care each year. Once you reach this amount, you’ll pay the rest until the new plan year begins.

-

Type 3 Major Annual Maximum: $750 per person.

-

Annual Maximum Per Person: $1,500 total per year.

-

Orthodontic Lifetime Maximum: Not included in this plan (listed as N/A).

Disclaimer: Annual maximums and orthodontic benefits vary by plan. Check your plan summary for the amounts that apply to your coverage.

Waiting Periods

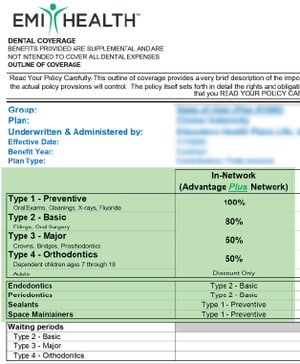

A waiting period is how long you must be enrolled before certain services are covered. Your plan summary breaks this down by service type:

-

Preventive (Type 1): No waiting period — covered right away.

-

Basic (Type 2): Covered after 3 months.

-

Major (Type 3): Covered after 6 months.

-

Orthodontics (Type 4): Not applicable for this plan.

Disclaimer: Waiting periods differ depending on the plan. Always review your plan summary to know when your coverage begins for each service type.

Choosing Between Plans?

If you’re comparing dental plan options, start by asking yourself a few key questions about your budget, dentist preference, and expected care needs.

Do you want to keep your current dentist?

Use our Provider Search Page to check before you choose a plan. Staying in-network saves you money.

Some plans only cover in-network providers, while others allow out-of-network coverage at a reduced rate.

Look for:

• "In-Network vs Out-of-Network" section (often near the top chart)

• "Network / Reimbursement Schedule"

• Terms like MAC, R&C, or No Coverage

Tip:

If your dentist is not in the network, look for plans that reimburse using MAC (Maximum Allowable Charge) or R&C (Reasonable & Customary)—these allow some out-of-network flexibility.

Are you covering a spouse or kids?

Look for:

- "Dependent Coverage" in the orthodontics or preventive sections

- Age limits listed under fluoride, sealants, or orthodontics

- “Type 4 – Orthodontics” section

Tip:

Most plans cover sealants and fluoride only up to age 16, and orthodontics for children 7–18.

Will you or your family need braces?

Orthodontic coverage isn’t always included—and often has strict limits.

Look for:

• "Type 4 – Orthodontics"

• “Discount Only,” “No Coverage,” or specific coinsurance (%)

Tip:

Some plans cover orthodontics for children only, and only in-network. Adult orthodontics is often listed as “Discount Only” or not covered.

Do you expect major dental work (like crowns or dentures)?

These fall under Type 3 – Major services and can be expensive.

Look for:

• "Type 3 – Major" coverage percentages

• Frequency limitations (e.g., “1 every 5 years per tooth”)

• Implant and anesthesia coverage

Tip:

Major services are usually covered at 40%–50% in PPOs, but copay plans often use fixed fees listed in a separate schedule.

Do you want predictable, fixed costs for each dental visit?

Copay or DHMO plans offer set fees instead of percentages.

Look for:

• “See Co-Pay Schedule” or “Fee Schedule” under most categories

• No coinsurance percentages

• In-network only benefits

Tip:

If it says “See Co-Pay Schedule” in most sections and shows $0 deductibles, it’s a copay-style plan. These are good if you prefer cost certainty.

Are you only planning on getting cleanings and exams?

All plans include preventive care, but the cost and network rules may vary.

Look for:

• "Type 1 – Preventive"

• Coverage level (typically 100%)

• “In-Network” column vs “Out-of-Network” coverage

Tip:

Preventive services are almost always free in-network, but out-of-network coverage may be limited or not covered at all on some plans.

Are you okay with paying a little more each month for more provider flexibility?

Plans with wider provider access usually come with higher premiums.

Look for:

• Monthly rates (Employee / Two-Party / Family)

• Out-of-Network reimbursement details

• “MAC” or “R&C” language

Tip:

Compare premiums shown at the bottom of the summary with flexibility offered in the coverage chart. PPO plans often cost more but let you see more dentists.

-

Utah

-

Arizona

-

Texas

-

Georgia

Utah

Premier (-A/-C/-D) Networks4,000+ dentists in UtahOut-of-State Coverage: -A-Aetna Dental Administrators network, -C-Cigna network, -D-Dentemax networkAdvantage (-A/-C/-D) Networks3,000+ providers in UtahOut-of-State Coverage: -A-Aetna Dental Administrators network, -C-Cigna network, -D-Dentemax networkTDA PPO2,900+ providers in UtahDHMO UT360+ providers in UtahValue DiscountValue network in Utah

Arizona

Summit Network

Cigna dental network.

121,000 dentists nationwide

715,000 access points nationwidePremier-D/Advantage-D/Choice-D NetworksDentemax PPO network.73,000 dentists nationwide277,000 listed access points nationwidePremier-A/Advantage-A/Choice-A NetworksAetna Dental Administrators network.67,000 dentists nationwideTDA-PPO4400+ ProvidersDHMO AZIncludes General and Specialist Dentists2900 providers in ArizonaValue DiscountA discount dental program, not an insurance product.Careington Network

Texas

Premier-D or Advantage-D NetworksDentemax PPO network.over 32,000 dental providers state-widePremier-A or Advantage-A NetworksAetna Dental Administrators network.over 36,000 dental providers state-wideSummit Network

Cigna dental network.

121,000 dentists nationwide

715,000 access points nationwideValue DiscountCareington network

Georgia

Premier-D or Advantage-D NetworksDentemax PPO network.over 32,000 dental providers state-widePremier-A or Advantage-A NetworksAetna Dental Administrators network.over 36,000 dental providers state-wideSummit Network

Cigna dental network.

121,000 dentists nationwideValue DiscountCareington network

How to Search for In-network Providers

To get the most from your EMI Health benefits—and avoid unexpected costs—it’s important to see providers in your plan’s network. That starts with two simple steps:

Step 1: Find Your Plan’s Network

Before you search, you’ll need to know which network your plan uses. You can find this in your plan summary, located in the back of your enrollment booklet or in your EMI Health member portal after you enroll.

Look for names like:

Step 2: Use the Provider Search Tool

Then follow these steps:

-

Select your network from the dropdown list. (Use the name you found in your plan summary.)

-

Choose your provider type (e.g., dental, medical, vision).

-

Enter your ZIP code or city to see local providers.

-

Filter by specialty, gender, language, or other preferences.

Why It Matters

Seeing an in-network provider means:

-

Lower out-of-pocket costs

-

No surprise billing

-

Simplified claims and coverage

If you're unsure about your network, reach out to EMI Health Member Services—we're here to help you find the care you need.

Start Your Search for In-Network Care

Out-of-Network Coverage: MAC vs. R&C

If you visit a dentist who isn't part of your plan's network, your dental insurance will determine how much it pays based on one of two methods:

| Feature | MAC (Maximum Allowable Charge) | R&C (Reasonable & Customary) |

| How reimbursement is calculated | Limited to the plan's max allowoable | Based on average fees in your area for similar services |

| Plan payment | Limited to the plan's max allowable amount | Based on typical local charges (often higher than MAC) |

| Your cost | You pay the difference if your dentist charges more than the plan allows | You pay the difference if the charge exceeds the "customary" limit |

| Flexibility | Lower reimbursement out-of-network | More generous reimbursement out-of-network |

| Best for | Members who stay in-network | Members who may need to go out-of-network |

| Typical reimbursement level | Lower | Often higher than MAC |

Tip: To minimize unexpected expenses, always check if your dentist is in-network using our Provider Search Page. For detailed information about your plan's out-of-network coverage, refer to your plan summary located at the back of your enrollment booklet or access your plan documents through the EMI Health member portal after enrollment.

Customer Service

Whether you’re looking for help with benefits, claims, ID cards, or something else—we’ve got a knowledgeable, friendly team ready to assist.

OR send us an email at cs@emihealth.com

We’re committed to making your experience as smooth as possible. If something doesn’t make sense, just ask—we’ll walk you through it.